In the world of cryptocurrencies, having a diverse portfolio is key. But, sometimes you need quick access to cash without exchanging your valuable holdings. This is where copyright-Collateralized loans come in. By using your Bitcoin as collateral, you can access a loan from platforms that offer rapid approval and customizable terms. These loans empower you to harness your copyright wealth while retaining ownership of your assets. Whether you need funding for a business venture, personal expenses, or simply an investment opportunity, copyright-Collateralized loans provide a reliable solution for unlocking liquidity in the copyright space.

Tapping into Your BTC Holdings

Holding Bitcoin hasn't always mean holding onto it statically. You can exploit your BTC holdings to amplify your wealth through borrowing power. Platforms offer copyright-backed loans, allowing you to obtain funds using your Bitcoin as security. This opens up a world of possibilities, including investing in other assets, starting new projects, or even merely paying for everyday expenses without disposing your Bitcoin. Remember to carefully research the terms and conditions of any lending platform before involving yourself, as interest rates and return policies can vary widely.

- Evaluate your financial goals and risk tolerance when exploring borrowing power options.

- Diversify your investments across different asset classes to mitigate potential risks.

- Monitor the value of your Bitcoin holdings regularly and adjust your loan proportion accordingly.

BTC Loans: Fast, Secure, and Decentralized Finance

Revolutionize your finance needs here with innovative BTC loans! Access fast funds seamlessly through our trustworthy {decentralized{ platform. No centralized banks required, just honest conditions and complete control over your bitcoin. Unlock the potential of copyright lending with BTC loans today!

- Benefit the speed of digital asset transactions

- Access exclusive financial

- Reduce reliance on legacy structures

Unlock Your Bitcoin With copyright Collateral Loans

Are yourselves looking to utilize the value in your Bitcoin without liquidating it? copyright collateral loans offer a smart solution. By using your Bitcoin as assurance, you can secure a loan in traditional currency. This lets you harness the power of your copyright holdings for numerous purposes, such as financing investments, covering expenses, or simply growing your business. The interest conditions on copyright collateral loans are often favorable, and the application process is commonly rapid.

- Additionally, copyright collateral loans offer adaptability as they incorporate varying loan sums and repayment schedules.

- Upon taking out a copyright collateral loan, it's vital to meticulously investigate different lenders and evaluate their agreements.

- Bear in mind that the value of Bitcoin can vary, so it's crucial to track your loan-to-value ratio and ensure you preserve sufficient assurance.

Bitcoin-Backed Lending

The decentralized finance (DeFi) space is rapidly evolving, with Bitcoin-backed lending emerging as a innovative solution to unlock financial inclusion. By leveraging the transparency of Bitcoin as collateral, borrowers can access funding without relying on traditional institutions. This new era of lending fosters {financialliteracy, enabling individuals and businesses to interact in the global economy with greater autonomy.

Amplify Your Future with Borrow Against Bitcoin

Unlocking the value of your Bitcoin holdings has never been easier. With our innovative platform/solution/service, you can rapidly borrow against your digital assets/copyright/Bitcoin portfolio. Transform your Bitcoin into liquidity/capital/funds to pursue your dreams, invest in opportunities/weather financial storms/fund your ventures, or simply enjoy the flexibility/freedom/control that comes with having immediate access to capital. Our user-friendly process ensures a efficient borrowing experience. Don't let your Bitcoin sit idle - maximize its potential today.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Ralph Macchio Then & Now!

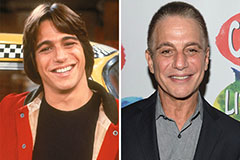

Ralph Macchio Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Batista Then & Now!

Batista Then & Now!